National healthcare spending reached $5.3 trillion in 2024 as Americans continued to ravenously consume healthcare coming out of the coronavirus pandemic, according to a new report from CMS actuaries.

Growth in healthcare spending continued to outpace that of the overall economy. As a result, healthcare’s share of the U.S. gross domestic product increased from 17.7% in 2023 to 18% in 2024, researchers said in the report released Wednesday in Health Affairs.

The sharp health spending growth was not driven by increasing costs for goods and services. Instead, it was fueled by intense consumer demand for medical care, and changes in what types of medical care was consumed, CMS actuaries said.

“Prices are a factor. They’re part of the equation. But non-price factors were the driver,” Micah Hartman, a statistician with the CMS’ Office of the Actuary, said in a call with press on Wednesday.

U.S. healthcare spending reached $5.3T in 2024, the second year of growth above 7%

The research confirms anecdotal reports from payers that they were walloped with medical spending in 2024. Private insurers especially complained that demand for care was much stronger than anticipated, pressuring the sector while benefiting hospitals, doctor’s offices and other providers.

Higher utilization continued into 2025. Payers are bracing themselves for it to carry into this year, too, citing the rising burden of hospital care, more intense behavioral health needs and chronic conditions, and the growing use of pricey GLP-1 drugs for weight loss.

But “the future of health care spending remains uncertain,” CMS actuaries wrote in the report, citing significant demographic shifts, regulatory changes and technological advancements the industry will absorb in the coming years.

Utilization jacked up health spending

CMS actuaries said the extreme demand for medical care was evident in elevated spending on personal healthcare — healthcare goods and services that are actually used by patients and not directed toward administration, equipment or other investments.

Taken together, 2023 and 2024 had the sharpest growth in personal healthcare spending the U.S. has seen in more than three decades, according to the report.

Growth in 2023 and 2024 averaged at 8.9% per year, a rate that hasn’t been seen since 1991 and 1992, when an economic recession sent personal healthcare skyrocketing.

The strong back-to-back annual growth was the most surprising finding from the analysis, Hartman said.

Overall, U.S. healthcare expenditures were up 7.2% in 2024, according to the report. Hospital care, physician and clinical services and retail prescription drugs all contributed more to overall growth that year than in the years prior to COVID-19.

Spending accelerated particularly quickly for hospital care, which accounted for $1.6 trillion in health spending in 2024 — up 8.9% from 2023.

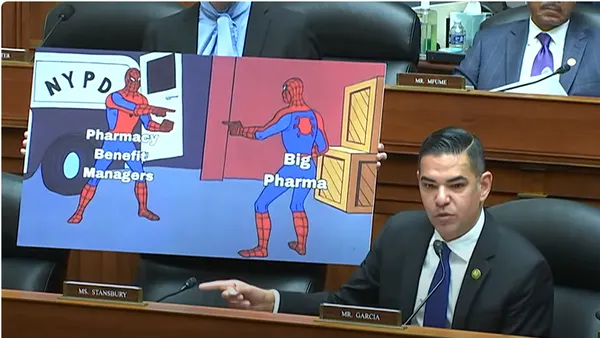

In comparison, spending on physician and clinical services was up 8.1% and spending on retail drugs was up 7.9%, as demand for GLP-1s for diabetes and weight loss were offset by slowing price growth and fewer new drugs launched, according to Anne Martin, an economist in the CMS Office of the Actuary’s National Health Statistics Group.

The federal government remained the largest sponsor of U.S. health spending in 2024, accounting for $1.7 trillion, or roughly one-third of expenditures, that year. That’s an increase of 5.5% compared to 2023.

A major driver of that growth was the rising taxpayer burden of more generous subsidies for Affordable Care Act plans, the CMS actuaries said. In total, the U.S. spent $149.5 billion on the ACA marketplaces in 2024, with Washington financing almost four-fifths of that amount, according to the report.

The enhanced financial assistance expired at the end of 2025. Republicans in Congress pointed to the steep cost of the subsidies as one reason why they shouldn’t continue, though Democrats caution the savings to the federal government will come at the expense of millions more Americans becoming uninsured.

In 2024, the federal government was also on the hook for higher Medicare spending, thanks to provisions in the Inflation Reduction Act of 2022 that reduced cost-sharing for seniors, according to the Health Affairs report.

Medicare, the insurance program for U.S. seniors and disabled individuals, continued to be the largest single source of spending, driving 21% of the nation’s total health expenditures in 2024.

Meanwhile, Medicaid spending growth actually decelerated for Washington, as states resumed eligibility checks coming out of COVID-19. Millions of low-income individuals were removed from the safety-net coverage during this process, called redeterminations.

At the same time, higher federal match rates for Medicaid were phased out — increasing program’s financial burden on states.

Healthcare spending by state and local governments swelled 12.1% to reach $859.7 billion in 2024, a faster growth rate than the prior year mostly due to rising Medicaid spending, CMS actuaries said.

Interestingly, redeterminations caused Medicaid spending growth to slow for the U.S. overall in 2024, because of the loss of enrollees.

However, spending per enrollee spiked, surging to 16.6% in 2024. That’s compared to growth of 6.5% in 2023. That’s because Americans who remained in Medicaid tended to be sicker and therefore more expensive, researchers said. In addition, states notched more supplemental payment agreements with hospitals and medical clinics in Medicaid.

Those arrangements, called state-directed payments, have increased as providers clamor for higher Medicaid rates. However, they’re set to be limited due to the GOP’s “One Big Beautiful Bill’ signed into law last summer.

Overall, U.S. households spent $1.5 trillion on healthcare in 2024, representing a growth rate of 6.9%, roughly similar to the prior year.

Though growth in spending on premiums for Medicare and private health insurance accelerated, that was offset by slower growth in out-of-pocket spending such as co-pays and deductibles, actuaries said. Worker contributions to their employer-based coverage also slowed.

As for employers themselves, private businesses’ health spending reached $967.4 billion in 2024, according to the report. The lion’s share of that sum went toward their share of employees’ health coverage.