The federal government will pay an estimated $76 billion more to cover Medicare Advantage seniors this year than it would if those same seniors were in traditional Medicare, according to new estimates from an influential advisory group.

It’s a smaller sum than last year thanks to the continued phase-in of a new risk adjustment model. Overpayments were estimated to reach $84 billion in 2025.

Still, the report released Friday by the Medicare Payment Advisory Commission is likely to add more fuel to concerns about overpayments in the privatized Medicare program, which has grown to cover more than half of all Medicare enrollees.

“When you read this chapter it’s hard not to be shocked at the total amount of money going into MA rebates, the coding issues, the lack of data on extra benefits and recognizing how much those are costing the taxpayers,” Stacie Dusetzina, a MedPAC commissioner and health policy professor at the Vanderbilt University School of Medicine, said during MedPAC’s meeting Friday. “It would be hard for most of us to look at $76 billion in potential overpayments and not think that could be spent more efficiently.”

‘Irresistible incentives to play the game’

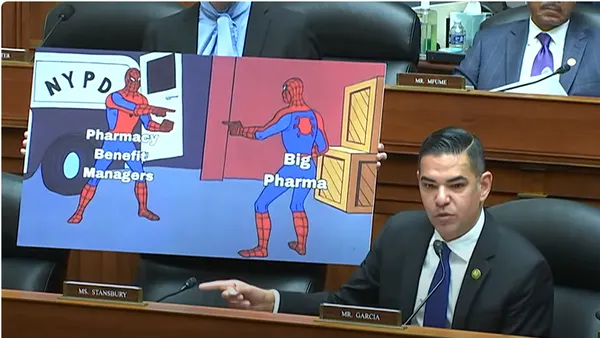

MedPAC’s annual status report on MA is highly anticipated, given rising evidence that private insurers are gaming the program’s payment system in order to increase profits.

In MA, the government pays private insurers a flat fee for covering Medicare seniors’ care, adjusted for the sickness of their members. As a result, insurers are incentivized to exaggerate their members’ health needs to inflate reimbursement from the government, a practice called upcoding.

MA is also more expensive than traditional Medicare because of favorable selection, when beneficiaries turn out to be healthier than expected. MA enrollees tend to use less medical care than seniors in traditional Medicare, according to research.

Without those two factors, MA and traditional Medicare spending would be comparable, MedPAC analysts found. Specifically, government payments to MA plans would be 99% of those in its fee-for-service sister program. But favorable selection adds 11 percentage points, and increased coding intensity adds another 4, according to the status report.

MA “creates irresistible incentives to play the game,” MedPAC Commissioner Scott Sarran, the chief medical officer of dementia care startup Harmonic Health, said. “You have to do it as a plan in order to be competitive.”

As a result, MA spending will be 114% of spending in fee-for-service Medicare this year — which translates into a “substantial amount” of payments, given the rising share of Medicare seniors electing into MA, said Luis Serna, a principal policy analyst with MedPAC. In 2025, almost 35 million seniors were in the privatized Medicare program.

Still, the $76 billion estimate is lower than last year’s projection. MedPAC researchers said the difference is due to a program enacted by the Biden administration meant to mitigate higher payments from coding intensity.

After the new risk model, called V28, was introduced, MA payments dropped relative to traditional Medicare, without affecting plan benefits or availability, analysts said.

V28 has curbed coding intensity since 2024

However, V28 is not a perfect solution. The model represented an across-the-board adjustment, penalizing both plans that weren’t upcoding — typically small, regional insurers covering fewer beneficiaries — and those that were.

Multiple commissioners said they were concerned that MA plans playing by the rules were being unfairly dinged by V28, with Commissioner Tamara Konetzka, a public health professor at the University of Chicago, calling it a “very blunt tool.”

Though, organizations with more coding intensity were more affected by V28, analysts noted. MedPAC didn’t name specific insurers. But UnitedHealthcare, the largest MA insurer with some 8 million enrollees, has been accused of upcoding more intensely than its peers — and the company has disproportionately struggled to absorb V28, according to executive comments and industry analysts.

V28 has “improved the fairness” of MA’s risk adjustment system, said Andy Johnson, a MedPAC principal policy analyst.

Still, the huge delta between MA and fee-for-service Medicare spending highlights a core problem with the MA payment system, commissioners said.

The findings are “very depressing,” noted Commissioner Lynn Barr, a founder of accountable care organization Caravan Health.

Health insurers will be able to skirt any attempts to curb upcoding as long as the underlying payment chassis remains in place, she said.

“The problem is that it’s just so profitable,” Barr said. “They can make so much money on coding that they’re not doing what we want them to do, which is reducing the cost of care, better management of patients — actually the promise of MA plans. What they can actually do for this country is great. But we have to take away the incentive for them to do everything but that.”

Discord over methodology

For the report, MedPAC analysts generalize estimates to the entire MA population based on data from individuals who switch from traditional Medicare to MA. That methodology has sparked significant criticism from MA organizations, which instead point to industry-funded research that MA is actually cheaper for taxpayers.

The methodology “fails to account for key differences between Medicare Advantage and Fee-For-Service,” Rebecca Buck, a spokesperson for MA lobby the Better Medicare Alliance, said over email. “Medicare Advantage provides more value for beneficiaries and the government, and we will continue to push for more accurate data to aid policymakers in their decisionmaking.”

Some MedPAC commissioners agree that the methodology is imprecise. Focusing solely on Medicare “switchers” instead of new entrants or long-term enrollees creates a “narrow and biased sample,” Brian Miller, a healthcare professor at Johns Hopkins University, said.

“I’m in directional agreement that some Medicare Advantage plans are overpaid but I do not agree with the estimated magnitude due to material methodological flaws,” Miller added.

MedPAC analysts on Friday pointed to a number of studies that backed up their findings of upcoding and favorable selection in MA.

And even if the $76 billion figure is slightly off, “the evidence that the MA program is at least somewhat overfunded is persuasive,” Sarran said. “We can disagree about orders of magnitude or methodology but the overall directional conclusion I think is quite clear.”

MedPAC’s findings are likely to turn up the already harsh spotlight on MA insurers. Curbing upcoding has emerged as one area of bipartisan consensus in a Congress up against a fence to do something about healthcare affordability.

At the same time, antitrust regulators have shown themselves increasingly willing to tackle what they view as Medicare fraud.

UnitedHealth is currently being investigated by the Department of Justice over its MA billing practices. And just on Wednesday, affiliates of Kaiser Permanente — a nonprofit health plan — agreed to a record $556 million settlement with the DOJ over upcoding allegations.

The MA status report will officially be presented in MedPAC’s March 2026 report to Congress.