The health insurance industry has had a tough few years.

But 2026 is poised to be a reset period, where efforts from insurers to stabilize their finances, operations and public images could start to bear fruit, experts said.

Margins should begin to improve this year, thanks to reimbursement hikes and payers rejiggering their plans to make them more profitable. Medicare Advantage profits in particular should tick up, offsetting some ongoing volatility in the Affordable Care Act and in Medicaid, experts predict.

Moreover, Republicans in Washington are unlikely to pass any drastic health insurance reform, given how chock-full last year was with changes for the sector — and the looming midterm elections.

Still, managed care companies have a ways to go to recover flagging profits, after margins last year hit their lowest point in two decades, according to accounting firm PricewaterhouseCoopers.

Spending is expected to remain high, driven by expensive specialty pharmacy care, high behavioral health utilization, the rising pervasiveness of chronic conditions and growing prices for hospital services. The cost environment is contributing to a “deteriorating” outlook for the health insurance sector, credits ratings Fitch Agency said in late December.

Even if payers get on more stable ground this year, health insurance costs remain alarming for Americans, sparking public calls for change and growing antipathy to private insurers on Capitol Hill.

Just 24% of Americans rate U.S. healthcare coverage positively, according to a November poll from Gallup — the lowest rating the analytics firm has recorded in two decades.

Amid the turmoil, insurers will continue focusing on improving their relationships with customers, including by whittling away barriers to healthcare access and using artificial intelligence to try and streamline clunky member experiences.

Meanwhile, megabrands will take advantage of the challenging environment to snap up smaller regional plans, technology and pharmacy assets, and physician practices, even as worries mount about shrinking competition in the U.S. healthcare sector.

Here’s what experts see coming down the pike for health insurers in 2026.

ACA markets on edge of death spiral

More generous subsidies for ACA plans lapsed at the end of 2025, but the debate over a posthumous extension has continued on Capitol Hill. Bipartisan lawmakers are trying to hammer out a compromise to make an extension more palatable to Republicans, but experts think it’s highly unlikely that the subsidies return — even in a different form — given staunch opposition from the brunt of the GOP.

“I would bet against them coming back,” said Matt Fiedler, a senior fellow at the Brookings Institution’s Center on Health Policy. “It’s more likely than not that they remain dead.”

Without the subsidies, monthly premiums are doubling on average this year for some 20 million Americans, even as some states step in to mitigate the pain on their residents.

Roughly 2 million low- and middle-income individuals are expected to lose health insurance coverage in 2026 as a result.

Early enrollment data for 2026 is not as bad as many market watchers feared, with sign-ups lagging last year but only slightly. Still, the U.S. won’t get a full picture of enrollment until the summer, when the CMS will release more information on how many enrollees actually elected to pay their premiums and stay in coverage for the year.

And in the meantime, some experts are worried the market could be teetering on the edge of a death spiral.

The loss of the enhanced premium tax credits could cause healthier individuals to flee the exchanges, resulting in higher morbidity among remaining enrollees. Insurers would then raise premiums to cover higher spending on those members — again causing less-sick individuals to leave the market.

This cycle would continue until it’s no longer viable for insurers to provide healthcare, and they exit the market, too.

CVS already left the ACA exchanges for 2026. Other payers could this year as well, depending on how drastically enrollment shrinks, Arielle Trzcinski, a principal analyst in Forrester’s healthcare division, noted.

“We do just go closer to this death spiral — folks just continuing to see costs go up, premiums just keep getting higher because of the fact that the risk pool has only worsened. And it will continue to get worse,” Trzcinski said.

Still, Raj Kumar, a managed care analyst at investment bank Stephens, said the ACA market is more on what he deemed a “maturation course” than a death spiral.

Despite the instability, some plans will entrench themselves more deeply into the market, while others less interested in the business will get out entirely, he said.

Meaningful health policy reform unlikely, though MA could see action

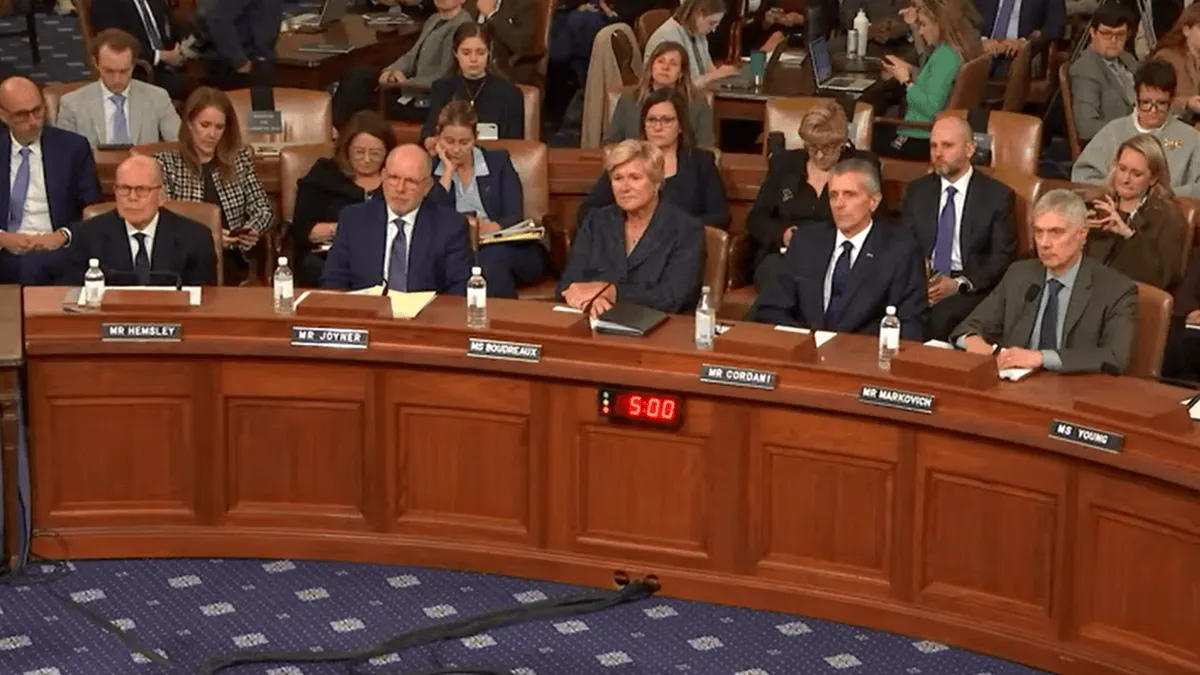

The rising cost of healthcare is creating intense pressure on the GOP, which controls both chambers of Congress and the White House, to act. In early January, Trump said he would meet with insurance executives to discuss ways to lower prices — a strategy that aligns with the president’s preference to negotiate deals with industry players instead of enacting regulatory or legislative reform, experts said.

Promises of a meeting were followed by Trump’s release of a bare-bones affordability plan on Jan. 15. In it, the president called on Congress to send money directly to consumers to purchase insurance, among other actions.

But lawmakers, including in Trump’s own party, are unlikely to push the blueprint through. Instead, they’re working on a bipartisan healthcare package that could be attached onto a government funding bill later this month. The package includes changes to how pharmacy benefit managers, influential middlemen in the pharmaceutical supply chain, operate.

The provisions would affect UnitedHealth, Cigna and CVS, all of which own major PBMs. Though, the bill is not a sure thing — and the reforms in it likely wouldn’t meaningfully improve healthcare affordability, according to health policy experts.

Similarly, Trump’s pressure on the insurance industry could result in a small announcement, like the voluntary prior authorization pledge major insurers signed onto last summer.

But the GOP doesn’t want to court controversy in advance of November’s midterm elections, so is unlikely to pursue any drastic reform this year.

“There may certainly be discussion about some of these issues this year. But are we going to see really consequential policy change on the scale we saw last year? I’m quite skeptical,” Fiedler said.

Still, the Trump administration is “historically erratic,” Jeffrey Davis, a senior director with health consultancy McDermott+, noted.

Regulators could one again try to ramp up scrutiny of potential overpayments in MA this year, experts said.

CMS Administrator Dr. Mehmet Oz tried to increase MA audits, but the effort ran aground after a rule underpinning the effort, called “RADV,” was tied up in court. The Trump administration could potentially reissue the RADV rule in 2026, Davis noted.

January alone has shown that regulators are interested in tackling profiteering in MA, amid bipartisan discontent with overpayments and care denials in the privatized Medicare program.

Tackling MA overpayments has been a focus for Oz, who walks a difficult tightrope between support for the program and acknowledging the need for improvement.

On Monday, the CMS took a step toward curbing upcoding in a proposed payment rule for 2027. Along with restricting one strategy insurers use to inflate their members’ risk scores, regulators also proposed a flat payment rate for 2027, well below the 4% to 6% update insurers were expecting.

Moreover, 2026 is the final phase-in of a new risk adjustment model, called V28, that’s proved a headwind to revenue and profit for MA insurers — especially UnitedHealthcare, which has higher coding intensity than its peers.

Still, final MA rates for 2027 are likely to be at least a bit more generous than in the proposed rule. Regulators normally lock in rates higher than their draft versions. In addition, midterm voting begins one month after the CMS releases benefit information on seniors’ MA plans for the coming year.

As such, Republican leaders in the CMS are unlikely to want to antagonize the powerful insurance lobby too dramatically in advance, experts said.

“Are we going to see really consequential policy change on the scale we saw last year? I’m quite skeptical."

Matt Fiedler

Senior fellow, Brookings Institution's Center on Health Policy

Margins tick up everywhere except Medicaid

Insurers have learned their lesson from elevated utilization over the past two years, and margins this year should reflect that, according to analysts.

Employer-sponsored plans — the buttress of the American health insurance system — will continue to perform reliably well. Meanwhile, plan bids in the ACA and MA markets suggest the industry will see more stable results in those businesses this year too, even if utilization remains high.

Managed care companies have been “a lot more conservative,” Stephens’ Kumar said. “At this point you should start seeing margin recovery from these trough levels.”

Insurers secured steep premium increases in the ACA exchanges, concerned about healthy individuals being scared away by 2026 sticker shock. Though insurers with large ACA footprints like Centene may contend with membership losses, margins should improve slightly either way, analysts said.

MA in particular appears poised for a rebound. Though insurers are operating against the same backdrop that depressed margins in 2024 and 2025, most have taken aggressive actions — setting higher prices, cutting benefits, nixing commissions for certain products, adjusting provider networks, exiting unprofitable markets — that should put them in a better position to keep elevated trend from hitting their bottom lines.

In addition, payers will enjoy a generous rate increase this year. Per-beneficiary federal funding for MA is set to increase by 8.5% in 2026, following a 2.4% increase in 2025 and a 4.5% increase in 2024, according to Arnold Ventures.

Plans appear to be using that higher funding to offset margin pressure, the philanthropy said in a report published January.

“We believe that Medicare Advantage can be a driver of margin upside, while we expect a level of investor skepticism around Medicaid and the ACA Exchanges until [insurers] prove out margin improvement,” J.P. Morgan analyst Lisa Gill wrote in a note in December.

“At this point you should start seeing margin recovery from these trough levels."

Raj Kumar

Managed care analyst, Stephens

Still, uncertainty remains. The 2026 rate increase may not fully offset high claims costs. Insurers are still adapting to the V28 risk adjustment model. Some face challenges improving their star ratings, quality scores that are tied to lucrative MA bonuses.

In addition, more seniors than normal switched MA plans for 2026, which introduces additional unpredictability, according to Fitch Ratings.

Overall, analysts expect MA margin to remain below target margins this year but be flat to up modestly compared to 2025.

As for Medicaid, the safety-net insurance program is the hardest market to predict, according to industry experts. But 2026 is set to be another tough year, with margins down slightly across the sector.

Insurers have been saying ad nauseum that states’ Medicaid payment rates are catching up to spending. But reimbursement continues to lag, and that will continue this year in part due to the massive reconciliation bill Trump signed into law last summer, analysts say.

The so-called “Big Beautiful Bill” contains major provisions for Medicaid that are expected to further reduce enrollment this year and into 2027, causing risk pool shifts that make it difficult for states to suitably set rates. The law will further stress states’ Medicaid budgets, which are already under immense pressure, experts said.

Despite signs pointing to a recovery, there is “significant uncertainty around the direction and pace of margins for every product except employer,” Bank of America analysts wrote in a recent research note.

Trust crisis causes insurers to pick up the pace on AI

Insurers pledged last year to make receiving healthcare cheaper and easier. But those promises may take a while to pan out — and in the meantime, trust in the industry continues to deteriorate.

To stop consumer sentiment from eroding further, payers will ramp up efforts to improve their brands and overhaul internal operations, according to Forrester’s Trzcinski.

“We’ve hit a critical point where we have to do something different. Health insurers can’t just keep doing the same thing over and over again. They have to revisit who they are, how they operate and the role that they want to play for consumers,” the analyst said.

As a result, insurers — which traditionally take a cautious approach to new technology, citing the need to keep member data secure — will start rapidly testing and deploying AI this year.

“2025 was a lot of payers dipping their toes into AI technologies,” said Ben Baenen, a healthcare partner at consulting firm West Monroe. “A lot of that understanding and cautious use casing is going to start to accelerate in 2026.”

Health insurers were already looking at AI to tackle functions that create friction for members and are easily automated, especially around utilization management, billing and communications. But in 2026, health insurers will increasingly use AI agents to call providers on a member’s behalf to check appointment times or double check a provider’s network status, experts said.

The companies will also roll out member-facing AI tools to help them estimate costs or explain complex insurance terms. Those could include generative AI chatbots, especially given that’s a gap in the market right now, experts said.

OpenAI launched a health-specific chatbot in January, citing in part the need to help Americans understand health insurance.

“The demand’s there. Someone’s going to fill it — and already is,” Trzcinski said. “So health insurers are going to think more critically about who fills that void,” and whether they should roll those chatbots out themselves.

Insurers will also increasingly leverage AI in billing functions, to help combat similar investments on the part of providers, experts said.

Providers are using AI to increase revenue per visit, including through ambient listening devices and more efficient revenue cycle management. Payers will invest in AI countermeasures to keep cost increases to a more manageable level — though it remains to be seen whether those efforts will be successful, whether in controlling costs or reducing friction for their customers.

M&A will accelerate, but megamergers still unlikely

Health insurance conglomerates like UnitedHealth, CVS and Cigna keep getting bigger, and the cost environment — paired with modestly lower interest rates coming out of 2025 — could provide fertile ground for them to continue to grow.

Given ongoing medical cost pressures, small regional payers could be more open to being acquired. Such plans, which normally enjoy positive brand equity in their local markets, could be attractive to national carriers looking to nab new members while burnishing their reputations, experts said.

That’s especially likely in Medicare Advantage. Though carriers in the privatized Medicare program have had a roller coaster few years, many insurers are still interested in getting deeper into MA plans in the long run, according to West Monroe’s Baenen.

That’s because historically, MA is much more lucrative than other types of insurance, according to research from KFF. And there are a lot of opportunities for acquisition: There were about 150 local and regional MA plans in 2025, according to Georgetown University’s Center on Health Insurance Reforms.

Buyers looking for regional health plans will be large, but not so big that they’ll attract outsized scrutiny from antitrust regulators, Stephens’ Kumar said.

“Health plans buying other health plans — I think you’ll see some of that more towards the Molinas of the world, who are more active on that front and somewhat smaller,” Kumar said. ”I don’t think anyone will allow UnitedHealth to buy a health plan.”

Still, companies like UnitedHealth that are building physician networks will continue to snap up doctor’s offices this year, especially through small deals that fly underneath federal regulators’ radar.

In particular, insurers will hunt for physicians in markets where they have a significant member presence. Meanwhile, independent physicians — already a dying breed — could be pushed to sell as the rising uninsured rate shrinks already tight margins.

Payers will also remain interested in home health and telemedicine assets to capitalize on consumers looking for cheaper entry points into the healthcare system.

But the biggest vertical integration plays in 2026 will be in technology, specialty care and pharmacy as insurers like Cigna and Elevance continue building out their lucrative health services divisions, experts said.

Pharmacy in particular is expected to drive insurer deals this year — especially for assets in specialty pharmacy, rare disease, oncology and infusion services, which drive vast amounts of pharmacy spend.

However, given opposition to big-ticket healthcare deals from the federal government, “I’d be hesitant” to predict any megamergers this year — especially vertical deals, Kumar noted.

“After the election, people thought that regulation would go down and the M&A cycle would start to churn back again. But this isn’t your Mom and Pop’s Republican Party, right? There’s definitely more stringency,” the Stephens analyst said.