“Unconscionable.” “Criminal.” “Just plain wrong.”

Those are some of the words that members of Congress used to describe health insurance companies during two hearings on Thursday — hearings that often turned contentious as lawmakers pilloried the CEOs of some of the largest U.S. payers for profiting at the the expense of average Americans.

The chief executives of UnitedHealth, CVS, Cigna, Elevance and Ascendiun were barraged with questions and criticism about care denials, market concentration and their multi-million dollar pay packages at a time when millions of Americans are losing health insurance.

“You have put profits above patients. And you have put profits above those who care for patients,” said Rep. Greg Murphy, R-N.C., during the hearing in front of the House Ways and Means Committee. “You have squarely abused your position of authority to deliver healthcare to patients in this country.”

Payer executives — Stephen Hemsley, the CEO of UnitedHealth; David Joyner, the CEO of CVS; David Cordani, the CEO of Cigna; and Gail Boudreaux, the CEO of Elevance — admitted that they could be doing more to improve affordability and access.

However, the CEOs attempted to deflect blame, arguing that other actors in the healthcare system, especially hospitals and drug companies, are responsible for higher costs.

The notable outlier was Paul Markovich, the chief executive of Ascendiun, the nonprofit parent company of the largest California Blues plan.

Health insurers are focused on profits just as much as everyone else, Markovich said in his prepared testimony.

“Our healthcare system is bankrupting and failing us,” Markovich said, adding that participants in the system — including health plans — have put profits ahead of patients or remained complacent about the complexity they’ve created.

“I’ve come to the conclusion that the system will not fix itself. The healthcare system needs some tough love and clear direction and the American government is in the best position to provide both,” he said.

‘The patient gets screwed’

The insurance CEOs found few allies over their marathon day of testimony, in front of the Energy and Commerce’s health subcommittee in the morning and the full Ways and Means committee in the afternoon.

Executives agreed that healthcare is confusing and inefficient, and that prices are too high. But they’ve already fixed or are working on some of consumers’ biggest gripes, like onerous prior authorization policies, and overall just aren’t to blame for higher costs, they said.

“The cost of healthcare insurance fundamentally reflects the cost of healthcare itself. It is more an effect than a cause,” Hemsley said in prepared testimony. “If insurance costs are going up even as we compete aggressively against other companies, it signals rising costs of health services, drugs and rising volumes of care activity.”

Premiums do reflect the cost of care, which has increased significantly due to America’s older and sicker population, heavy provider consolidation, the entrance of high-cost drugs into the market and other factors.

Still, the CEOs’ arguments that they keep costs low by negotiating with providers and drugmakers largely fell on deaf ears.

“There is not one single American that I have met that believes health insurers are effective at lowering costs,” said Ways and Means Chairman Jason Smith, R-Mo.

Lawmakers on both sides of the aisle were particularly concerned about rampant vertical integration. For-profit insurance giants are not just insurers — the companies also own physician groups, pharmacies, pharmacy benefit managers and other subsidiaries that give them outsized control over multiple markets of the U.S. healthcare system.

That control may be driving higher spending. For example, data shows that doctors and pharmacies affiliated with a plan are often paid higher rates than unaffiliated providers.

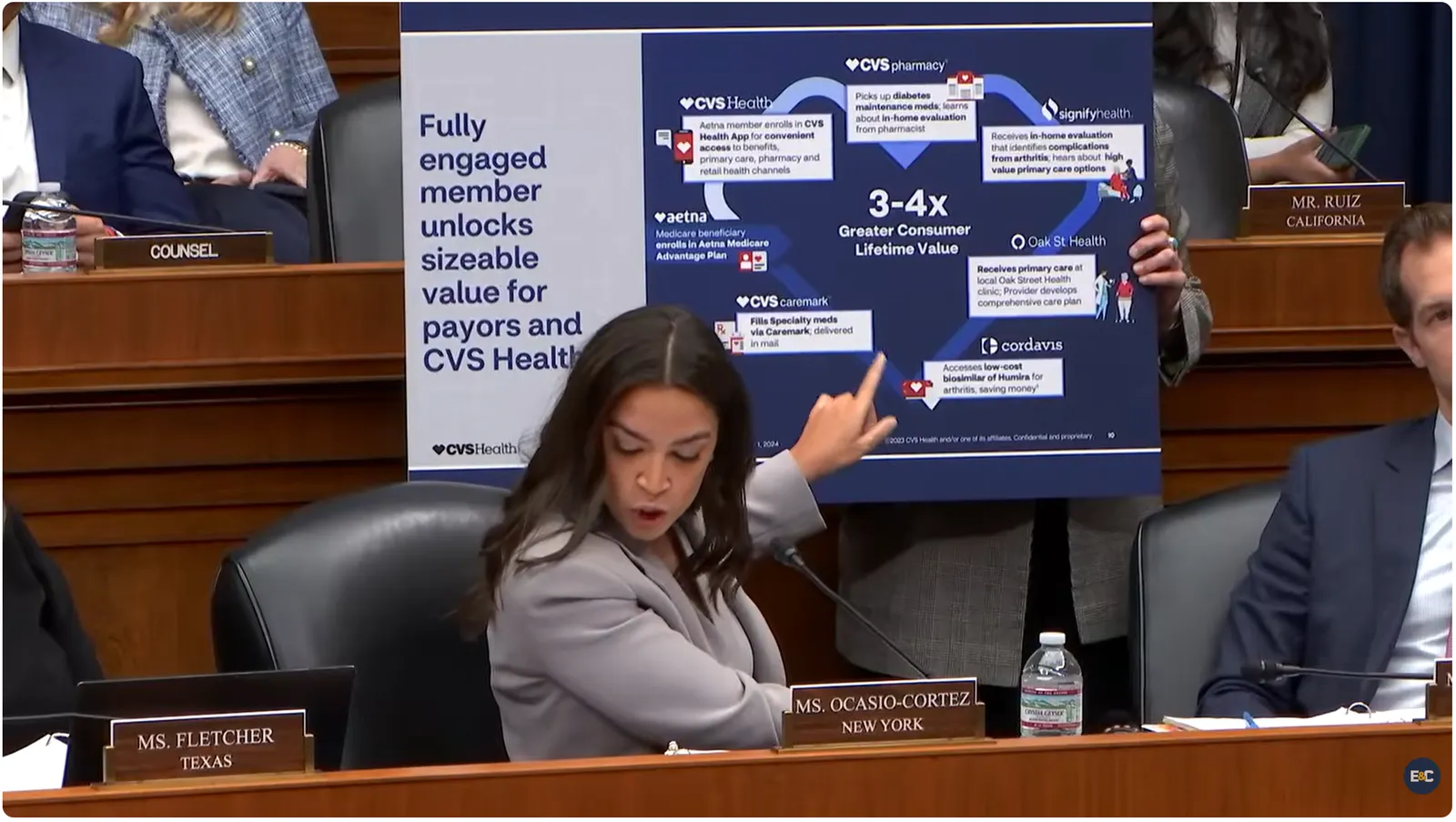

UnitedHealth and CVS, which both manage vertically integrated healthcare empires, received the brunt of flak for consolidation on Thursday. In one testy exchange, Rep. Alexandria Ocasio-Cortez, D-N.Y., cited a CVS investor conference in which the company touted how one consumer could get health insurance, medical care, prescriptions filled and even their drug manufactured all from CVS subsidiaries.

Joyner denied this amounted to market concentration. “I suggest it’s a model that works really well for the consumer,” the CEO said during the Energy and Commerce hearing.

“Yeah, I think it works very well for CVS,” Ocasio-Cortez replied. “The health insurance gets a cut, the pharmacy benefits manager gets a cut, the drug manufacturer gets a cut. And the patient gets screwed.”

Executives also attempted to defend their care review practices, arguing that stories of improper care delays and denials are unfortunate outliers and that they approve the lion’s share of claims.

But that doesn’t square with research, lawmakers said. Data on industry-wide denials is sparse and often contested by insurers. But 19% of in-network claims were denied in the Affordable Care Act marketplaces in 2023, according to one recent study from the KFF, and providers say denials are increasing.

High denial rates are especially concerning given other research finding that the large majority of denials are overturned if they’re appealed.

“This looks like your business model. It looks like you bet on wearing patients down and them not appealing and then they either decide to just eat the cost or they die before they get the care they need,” said Rep. Kim Schrier, D-Wash., during the Energy and Commerce hearing.

Lawmakers also attacked the CEOs for their pay packages, questioning the ethics of taking in millions of dollars in annual compensation when American families are struggling to afford healthcare.

The executives were also asked about negotiations with clients, the transparency of their plans and steps they’re taking to improve medical access in rural areas.

Largely, the insurance CEOs remained calm under fire during the questioning, though their measured responses were occasionally at odds with lawmaker intensity.

Hemsley was even criticized after thanking multiple representatives for their questions, when Rep. Buddy Carter, R-Ga., asked Hemsley whether he’s ever had to explain to a patient why their care was denied.

“Don’t thank me for the question,” Carter said emphatically during the Energy and Commerce hearing. “I practiced pharmacy for 40 years. I’m the one who had to look the patient in the eye. I’m the one who had to tell them that. On your behalf. It’s not fun.”

Hemsley’s deferential tone also rankled other members.

“The way you’re talking about this — it’s not sympathetic. It’s not compassionate. ‘I appreciate the topic.’ These are people’s lives,” said Rep. Nanette Diaz Barragán, D-Calif.

Sparring over health policy

During the hearings, lawmakers targeted their counterparts across the aisle almost as much as the CEOs.

Democrats slammed Republicans for steep healthcare cuts in the GOP’s tax and policy megabill passed last summer, and said it wasn’t too late for Congress to extend higher subsidies for ACA plans that expired at the end of 2025.

Meanwhile, Republicans aired concerns about fraud and waste in the exchanges set up by the ACA, and argued much of the country’s affordability crisis is due to the 2010 law.

At times, members of Congress used the executives as proxies, asking them to raise their hands if they agreed with one political point or another.

The CEOs generally avoided supporting specific reforms, instead saying they back general themes of price transparency, tackling fraud and reducing complexity in the healthcare industry.

Congress faces intense public pressure to improve healthcare affordability after the expiration of more generous subsidies for ACA plans. Some 20 million Americans in the exchanges will see their monthly premiums double on average for coverage this year as a result. About 4 million are expected to drop coverage entirely.

However, though price hikes in the ACA exchanges are particularly acute this year, 2026 is not an outlier.

The nation’s health spending reached $5.3 trillion in 2024, up more than 7% from the year prior and outpacing growth in the overall economy — an unsustainable situation, according to economists and health policy experts.

Facing rising costs, lawmakers have turned their focus to insurers — including Republicans. It’s an about-face for the party, which normally defends big businesses and privatized insurance. However, President Donald Trump has said he wants to meet with insurance CEOs to negotiate lower prices, and issued a bare-bones healthcare plan earlier this month that would tweak some of their practices.

Wall Street has been largely unconcerned, despite Congress and the Trump administration’s growing focus on insurers.

The stocks of UnitedHealth, Cigna, Elevance and CVS trended up on Thursday and remained basically flat in post-market trading, suggesting investors are unworried about potential of seismic change from Washington.