Dive Brief:

- CommonSpirit Health executives met with investors on Wednesday to lay out a plan to turn around its operating performance, following a recent earnings report that revealed the system had, once again, recorded an operating loss for fiscal year 2025.

- Although the nonprofit health system improved its performance during fiscal year 2025, departing CFO Daniel Morissette said CommonSpirit is still “not where we need to be financially.”

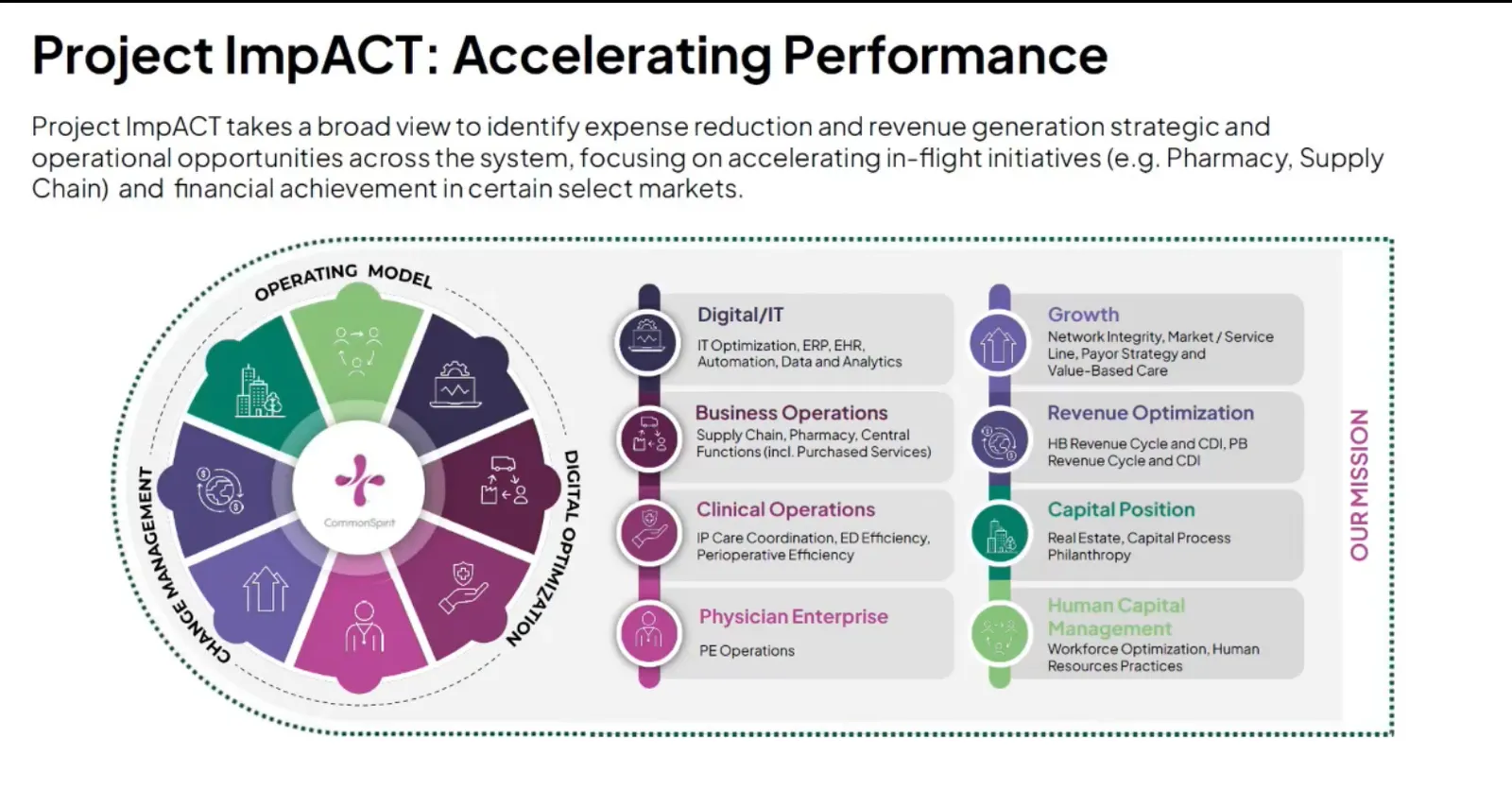

- The system hopes its new turnaround plan, called Project Impact, can help right the ship within one to two years, according to Morissette. At a high level, the project will evaluate opportunities for expense reduction and revenue generation at the national and facility level. Executives will unveil more details about the project later this fall.

Dive Insight:

CommonSpirit said it made progress shrinking its operating losses, growing patient volumes and controlling contract labor spend. Still, the health system attributed much of its improvement to one-time boosts from government payments, including $645 million from the Federal Emergency Management Agency related to the COVID-19 pandemic.

“We are focused on our underlying run rates,” Morissette said. “At a high level, I’d say we’ve worked hard, but have not made as much progress as is needed.”

The system’s operating loss shrank from $875 million in fiscal year 2024 to $225 million in 2025. Revenue increased, but operating expenses also climbed to $40.3 billion in 2025, up from $37.8 billion the year prior, driven by increases in supply and salary costs.

Meanwhile, the health system is eyeing growing headwinds, including the looming impacts of the One Big Beautiful Bill Act, which is expected to hit CommonSpirit’s bottom line in fiscal year 2028, and what Morissette called “payer mischief,” including payment delays and denials.

Those industry-wide pressures have created urgency around Project Impact, which is expected to help the system “accelerate performance and aggressively challenge headwinds,” according to CEO Wright Lassiter III.

Project Impact will address eight areas: digital and IT optimization, business operations, clinical operations, physician enterprise, revenue optimization, growth, capital position and human capital management.

However, CommonSpirit’s growth plans do not include increasing the size of its hospital portfolio, per its CEO.

“At this point, we’re not focused on hospital acquisitions. We’re primarily looking at ambulatory growth to meet the needs of our consumers and align with the future of healthcare delivery,” Lassiter said.

Over the last two fiscal years, CommonSpirit has added 90 new ambulatory care sites, with 34 of those facilities opening in the last year, according to its investor presentation. Now, the health system plans to expand carefully. That means that CommonSpirit is, for now, electing to not join its peers, including Ascension, in pursuing large acquisitions of major ambulatory providers.

“We’re all ears with partnerships, with acquisitions,” said Morissette. “But we’re also very fiscally disciplined about only paying what we believe we’re able to pay to make any acquisition or major expansions financially successful.”

CommonSpirit will also take a closer look at its underperforming markets, including Utah, Nebraska, Arkansas and Tennessee, to identify opportunities for optimization or those for transitioning out of the markets.