The Trump administration has taken a big step toward curbing Medicare Advantage overpayments, proposing a rule that would stamp out one strategy insurers use to inflate their members’ sicknesses to get higher reimbursement in the privatized Medicare program.

In a rule released Monday, the CMS proposed excluding patient diagnoses that aren’t linked to actual medical care from MA risk adjustment.

The policy would eliminate the financial motivation insurers have to mine their members’ medical charts for additional diagnoses, since insurers wouldn’t be able to use those additional diagnoses to inflate members’ risk scores.

CMS actuaries predict the change would save Medicare more than $7 billion in 2027, according to an economic analysis in the Medicare Advantage and Part D Advance Notice.

The rule is likely to face pushback from the health insurance industry, which argues chart reviews are an important tool to ensure payers have a full picture of their members’ health needs.

Still, some major MA payers have signaled they’re open to curbing the role of chart reviews and health risk assessments in risk scoring.

And pressure has been mounting on the Trump administration to act amid growing research, investigations and media reports suggesting that insurer gaming fuels tens of billions of dollars in MA overpayments.

The proposed updates will “bring renewed stability to Medicare Advantage ... by strengthening public trust in the program such that plans are forced to compete on the value they provide,” Alec Aramanda, the principal deputy director of the Center for Medicare, said in a call to discuss the advance notice late Monday afternoon.

“That’s instead of an arms race based on who can game the system better than the competition,” he added.

Regulators also proposed a small average rate bump — less than 0.1% — for MA plans next year. That equates to more than $700 million more flowing to MA plans.

Final payments will be higher after insurers code for their members’ conditions. CMS actuaries said payments will be 2.5% higher in 2027 than in 2026 after coding is factored in.

Still, the largely flat rate update is well below what industry analysts expected. MA watchers expected payment rates to be about 4% to 6% higher next year, due to sharp growth in Medicare’s underlying medical spending, the generous rate increase handed out by regulators for 2026 and the assumption that the Trump administration would be unwilling to antagonize the health insurance industry in advance of the midterm elections.

Influential payer lobby AHIP slammed the rule and threatened it would result in benefit cuts and higher costs for the 35 million seniors in the program.

MA is already seeing a contraction as major carriers cut benefits and exit underperforming markets in a bid to improve their margins after years of unexpectedly high costs. The changes have caused confusion and uncommonly high plan-switching for seniors for 2026, experts say.

The Alliance of Community Health Plans, an association representing nonprofit local payers, agreed, called the advance notice “disappointing and wholly unrealistic.”

Still, ACHP said it appreciated the CMS’ focus on curbing upcoding in MA, calling the exclusion of unlinked chart reviews from risk scores a “welcome step.”

CMS regulators said the payment rate reflects higher costs, and that the risk adjustment changes would ensure the long-term viability of the program.

The Trump administration is working toward an MA risk adjustment system that’s more simple, competitive and accurate — one that will equalize the playing field between insurers “regardless of size or resources,” Aramanda said.

Still, payment rates could tick up in the final payment rule after sustained lobbying from unhappy health insurers.

“To state the obvious, expect intense advocacy efforts/negative messaging from the carriers,” Jefferies analyst David Windley wrote in a Monday note on the rule. Otherwise, “expect plans to cut benefits substantially.”

Reworking risk adjustment

The federal government adjusts payments to MA plans based on the health needs of their members. Basically, payments are higher when a member is sicker and lower when a member is healthy. This system is meant to stop insurers from cherry-picking healthy enrollees, but also creates an incentive for them to exaggerate how sick their members are, including through intense documentation of their conditions.

Chart reviews — retrospective audits of member charts to identify and add new diagnosis codes — are not used in traditional Medicare, and are one of the highest contributors to MA overpayments, research suggests.

In 2022, one in six MA enrollees underwent a chart review that increased CMS reimbursement to their health plan, according to a KFF analysis published in November.

Chart reviews drove an estimated $24 billion in MA overpayments in 2023, congressional advisory group MedPAC found.

Concerns about risk adjustment gaming has fueled calls to overhaul the system for years. In 2024, the Biden administration enacted a new risk adjustment model meant to mitigate upcoding, called V28.

2026 is the final year that V28 is being phased in. Research suggests the model has helped curb overpayments, and insurance executives have blamed V28 for cutting into their profits.

Still, some Medicare watchdogs want the CMS to do more to fix issues in the underlying risk adjustment system — especially if it can do so without hurting insurers that aren’t upcoding, which was a criticism of V28.

Now, the CMS is proposing to exclude “diagnosis information from unlinked chart review records ... not associated with a specific beneficiary encounter,” such as a doctor’s visit, from the calculation of a member’s risk score starting in 2027.

Diagnoses found during chart reviews will be allowed if they’re tied to a medical encounter. Still, the proposal should restrict payers’ ability to profit off of diagnoses that aren’t linked to actual patient health needs.

And the CMS noted that the proposed risk adjustment changes in Monday’s rule would affect some insurers more than others.

MA carriers that use more of these reviews to report risk-adjustment diagnoses would be disproportionately impacted, regulators said.

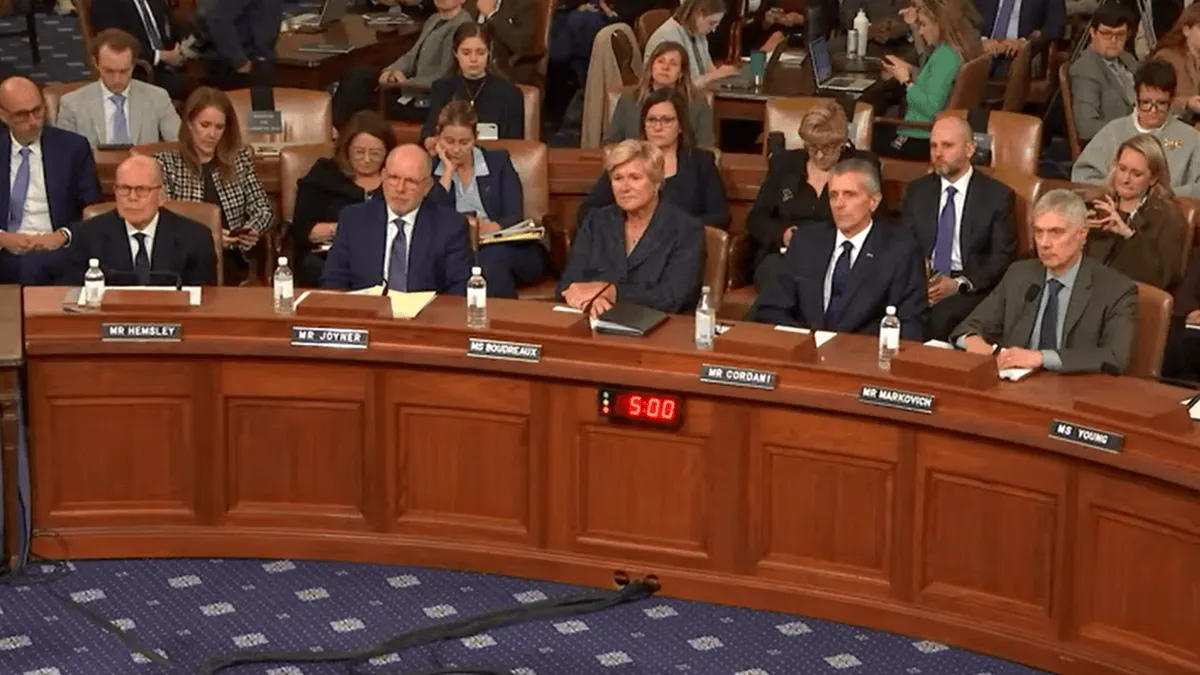

UnitedHealth, which owns the largest MA carrier with more than 8 million members, has been accused of maintaining an entire workforce dedicating to inflating its MA reimbursement. That includes coders to review medical records and nurses sent to visit members in their homes to find evidence of more diagnoses, according to a Senate Judiciary Committee investigation published earlier this month.

Though UnitedHealthcare has particularly been in the public eye for its use of chart reviews, other insurers — notably Centene, CVS and Elevance — have comparable levels of enrollees with extra diagnoses added through the audits.

Still, UnitedHealthcare is the largest payer in the program and therefore probably contributes more to overpayments, according to KFF.

UnitedHealth’s MA business is most exposed to the changes in the rule on a per-member basis, despite V28 already cutting into the company’s risk scoring advantage, according to Windley.

UnitedHealth did not respond to a request for comment.

Along with excluding diagnoses from unlinked chart reviews from risk scoring, the 2027 Advance Notice also proposes other changes to the risk adjustment model.

That includes using more recent underlying Medicare data to reflect more accurate costs from beneficiaries’ diseases and their demographics, regulators said.

The CMS also wants to exclude diagnoses from audio-only telehealth visits from risk score calculation.

Shares in major publicly traded payers plummeted in post-market trading Monday after the advance notice was released, with Humana down 12%, UnitedHealth and CVS down 9% and Elevance down 5%.

Comments on the proposed rule are open through Feb. 25. The rule will be finalized in early April.